Deploying a crypto trading bot without rigorous testing is a significant financial risk. How can you be sure your strategy will perform as expected in the volatile crypto market? The answer lies in a crucial simulation process. This is where backtesting crypto bots becomes an indispensable tool for every serious trader, providing the data-driven insights needed to validate a strategy before risking any capital. This guide breaks down everything you need to know.

What exactly is backtesting in crypto trading

In simple terms, backtesting is a method for stress-testing a trading strategy using historical market data. Instead of deploying a crypto bot with real funds and hoping for the best, you simulate how it would have performed in the past. This process feeds historical price data—from previous weeks, months, or even years—into your bots algorithm. The simulation then executes trades based on your AI crypto trading bot strategy, providing a detailed report on its hypothetical performance.

This is not just about checking for profitability. An effective backtest reveals the strategys behavior across different market conditions, such as bull runs, bear markets, and sideways consolidation. It acts as a time machine, allowing you to see potential outcomes and refine your approach without risking a single dollar. For anyone serious about undefined, it is the fundamental first step in separating a potentially successful strategy from a flawed one.

Why backtesting is a non negotiable step for traders

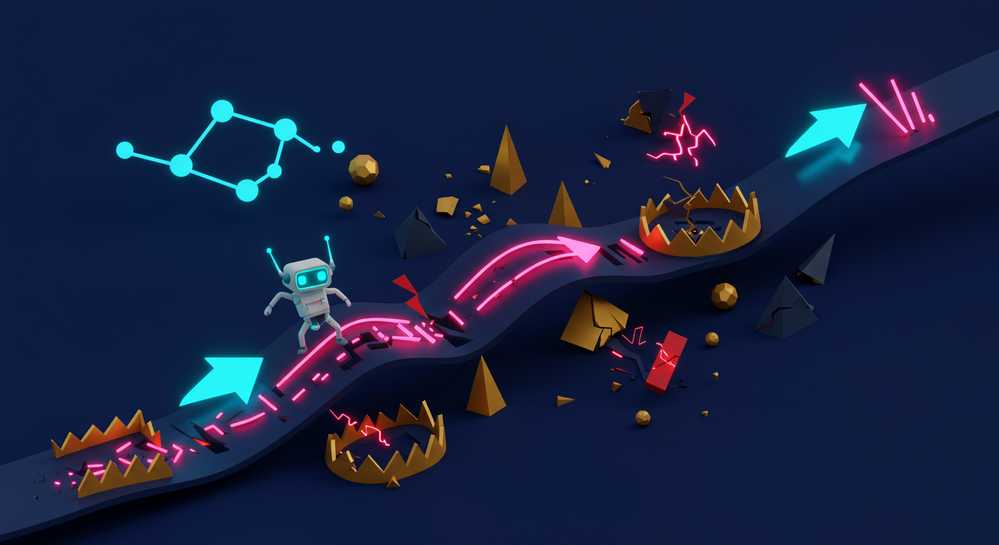

Deploying a trading strategy without prior testing is like navigating a minefield blindfolded. Backtesting illuminates the path, offering indispensable advantages for disciplined trading. This process is crucial for anyone using crypto bots, as it validates a strategy before any capital is at risk. It transforms abstract ideas into a concrete performance report based on historical facts.

- It helps you understand and quantify potential risks. A backtest reveals key metrics like maximum drawdown, the largest potential loss from a peak. This prepares you financially and psychologically for downturns.

- A raw idea is rarely perfect. Backtesting allows you to optimize parameters like stop-loss or take-profit levels. This iterative process refines your initial concept into a more robust and effective strategy.

- It replaces emotional decisions with data-driven confidence. A successful backtest provides evidence that your strategy works on historical data. This helps you stick to your plan during intense undefined.

- It grounds your expectations in reality. New traders often expect constant profits from their crypto bots. Backtesting shows both winning and losing periods, proving that drawdowns are a natural part of any system.

The core components of an effective backtest

A backtest is only as reliable as its components. To get meaningful results that translate well to live trading, your simulation must be built on a solid foundation. Here are the core elements that every effective session of backtesting crypto bots needs.

High quality historical data

The quality of your historical data is paramount. The data should be clean, accurate, and cover a long enough period to include various market cycles. It must contain the necessary information for your strategy, such as open, high, low, close prices, and volume for the specific timeframes you intend to trade.

A realistic simulation engine

The simulation must mimic real-world trading conditions as closely as possible. This includes accounting for factors that can impact profitability, such as:

- Trading Fees: Every trade incurs a fee from the exchange. While small, these costs add up over hundreds of trades and can significantly affect net profit.

- Slippage: In live markets, the price at which your order is executed may differ from the price you expected. A good backtesting engine models this.

Key performance metrics

Once the test is complete, you need to analyze the results using standardized performance metrics. Beyond just total profit, you should focus on metrics that give a complete picture of your strategys risk and reward profile, including Profit Factor, Win Rate, and Maximum Drawdown.

Common pitfalls to avoid when backtesting your bot

Even with the right tools, it is easy to fall into common traps that invalidate your backtesting results. Being aware of these pitfalls is crucial for creating a strategy that holds up in the unpredictable environment of live crypto markets.

Overfitting the strategy

Overfitting, or curve-fitting, happens when you excessively optimize your strategy to perform perfectly on a specific historical dataset. The strategy becomes so tailored to past data that it loses its ability to adapt to new, unseen market conditions. A strategy that looks incredible in a backtest but fails immediately in live trading is often a victim of overfitting. To avoid this, always test your strategy on an out-of-sample data period that was not used during the optimization phase.

Ignoring market evolution

The crypto market is constantly evolving. A strategy that worked perfectly two years ago may not be effective today due to changes in volatility, liquidity, or overall market dynamics. Be cautious of backtests that rely solely on very old data without confirming the strategys relevance in more recent market conditions.

Confirmation bias

This is the tendency to look for and interpret results in a way that confirms your pre-existing beliefs about a strategy. It is easy to discard a poor backtest result by blaming the market, rather than acknowledging a fundamental flaw in the strategy itself. To counter this, approach every backtest with objectivity and be prepared to abandon an idea if the data does not support it.

Ultimately, backtesting is not about finding a flawless strategy that never loses. It is an essential risk management tool for understanding how your crypto bot will likely behave. By using historical data to identify weaknesses, optimize parameters, and set realistic expectations, you move from gambling to calculated, data-driven trading. The insights gained are invaluable for navigating live markets with confidence. To apply these principles with a powerful and intuitive platform, explore the tools available at MevXBot .