On the morning of March 3, 2025, the crypto community was abuzz with a shocking story about an anonymous trader who earned up to $6.8 million in just 24 hours thanks to a perfectly timed “bottom fishing” decision. This story became a hot topic on financial forums when this trader seized the opportunity right before President Donald Trump announced the establishment of the U.S. National Crypto Reserve Fund, a move that could bring significant volatility to the cryptocurrency market.

50x Leverage and Extreme Risk

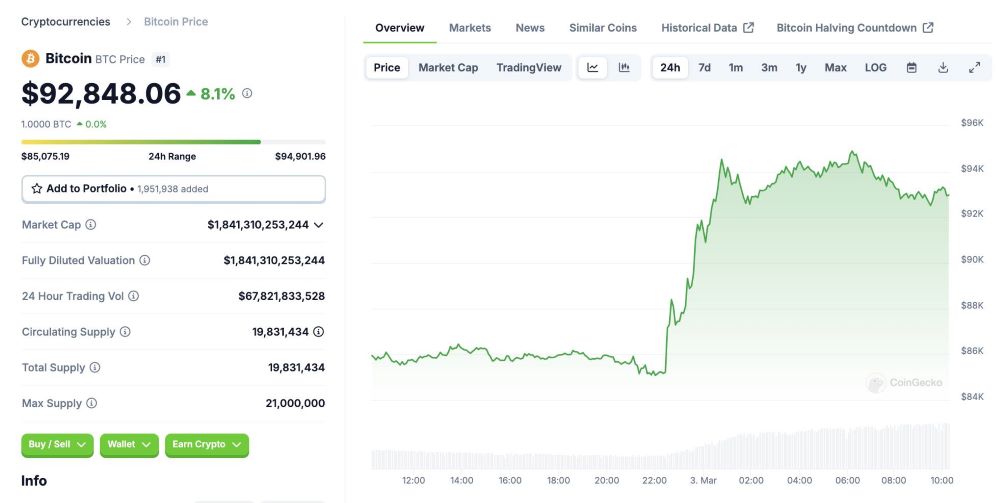

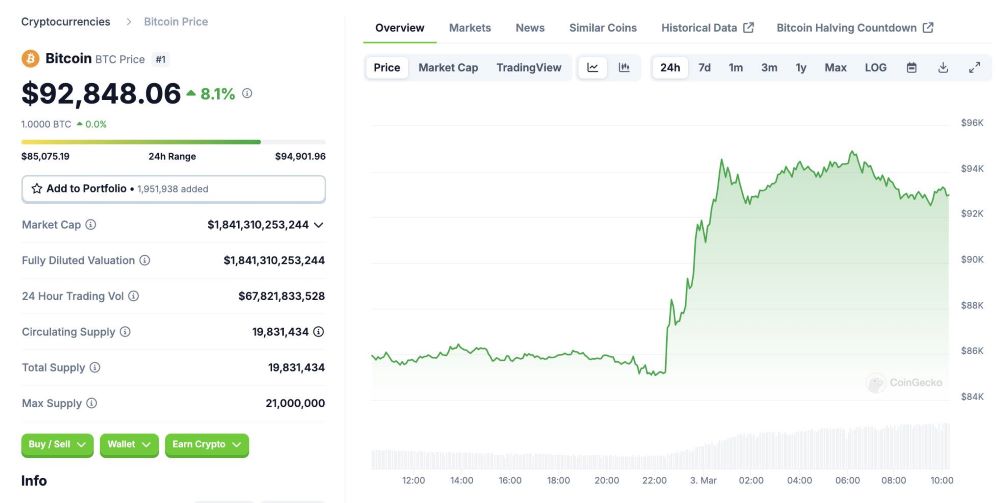

This anonymous trader executed an extremely risky yet sophisticated trade. According to data from Hyperliquid, a decentralized derivatives exchange (DEX), the trader opened two long positions with an extremely high 50x leverage on two key cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH). Specifically, he opened a long order with Ethereum worth $123 million at the price of $2,196 per ETH, while simultaneously opening a long order with Bitcoin worth $72 million at the price of $85,880 per BTC.

This meant that if the price of BTC and ETH dropped by just 2%, this trader would be liquidated entirely, losing all the initial funds placed. This was an extremely risky strategy, but if successful, the rewards would be enormous. Because of this, this trade has led many people to ask: Was this just a risky “big bet,” or did this trader have some insider information before the public?

Trump’s Announcement: A Breakthrough Turning Point

However, at that critical moment, an unexpected twist occurred. Former U.S. President Donald Trump announced the establishment of the National Crypto Reserve Fund and confirmed that the U.S. would hold reserves of several prominent digital assets, including Bitcoin, Ethereum, XRP, Solana, and Cardano.

This information immediately created a strong boost in the cryptocurrency market. Bitcoin instantly surged past the $94,000 mark, while Ethereum also recorded an impressive increase, surpassing $2,540. This was information that the anonymous trader certainly could not ignore.

Seizing the Opportunity, Taking Profits, and Earning Big

With this surge, the anonymous trader quickly began to take profits in stages, minimizing risk amid the market’s intense volatility. On-chain data shows that Bitcoin sell orders were executed in the price range of $87,500 – $91,399, while Ethereum was sold around $2,270. By 11:00 PM on March 2, this trader had closed nearly all positions and pocketed a massive profit of $6.8 million in less than 24 hours.

However, an interesting detail is that, despite earning a huge profit, this trader missed the opportunity to gain an additional $20 million if he had been patient for just a few more minutes. After Trump announced more details about the cryptocurrencies to be included in the reserve fund, the prices of Bitcoin and Ethereum continued to rise sharply, but the trader had already closed the orders too early.

A Wave Riding Move or Insider Trading?

Right after this trade was made public, a major question arose in the crypto community: Was this just a reckless “big bet,” or was there an element of insider trading behind it? This suspicion became even more serious as this trader opened long orders with extremely high leverage just before Trump made his crucial announcement. Some believe that this trader might have received insider information or had access to early details about the U.S. government’s plans.

Additionally, there were also suspicions about the use of money laundering techniques or wash trading to create fake transactions to artificially inflate asset prices before selling. Some analysts believe this trade could just be part of a more complex trading network designed to conceal non-transparent financial activities.

Enormous Risk and Reward

One of the standout points of this trade was the combination of extremely high risk and massive profit. Placing orders with 50x leverage meant that any price fluctuation could lead to either enormous gains or losses. Therefore, risk management and making the right decisions at critical moments are extremely important in trading.

This anonymous trader seized the golden moment to enter the trade, but the story also raises questions about transparency in derivatives trading and how cryptocurrency transactions can be manipulated in specific situations.

Impact on the Crypto Market

Although this trade brought significant profits to the trader, it also highlighted a concerning trend in the crypto market: manipulation and the lack of transparency in trading activities. Although DEX exchanges are often considered safe and decentralized, activities such as insider trading, money laundering, and manipulation can still occur, especially in large transactions that influence the entire market.

With the continuous development of trading trends and the strong influence of information on cryptocurrency prices, such trades will always attract the attention of the crypto community. Stay updated with the latest news and potential investment opportunities on MexVBot bringing you fast and accurate updates on the cryptocurrency market.