The global financial markets witnessed a major shock as President Donald Trump officially implemented new tariffs on three major trade partners: Canada, Mexico, and China. The immediate consequence was a sharp downturn in the U.S. stock market, triggering a wave of sell-offs in the cryptocurrency sector. Bitcoin (BTC), the leading digital asset, plunged below $86,062, wiping out its previous gains driven by the anticipation of a national crypto reserve fund.

Trump’s New Tariffs: The Spark for a Financial Crisis

Trump’s tariff policies were not entirely unexpected by economic analysts. On February 1, 2025, he signed an executive order imposing a 25% tariff on imported goods from Canada and Mexico, while also increasing additional tariffs on Chinese goods by 10%, bringing the total tariff on China to 20%. The primary objective of these measures was to address pressing issues such as cross-border fentanyl smuggling and human trafficking into the U.S.

After a 30-day waiting period for responses from Ottawa and Mexico City, Trump decided against making any concessions. His final decision, announced on March 3, 2025, immediately sent shockwaves through the financial markets. The Dow Jones and S&P 500 recorded sharp declines, while the Atlanta Federal Reserve lowered its Q1 2025 GDP growth forecast from -1.5% to -2.8%. Compared to a +3.9% growth rate just four weeks earlier, this alarming drop signaled that the U.S. economy was on the brink of a severe recession.

Bitcoin and the Cryptocurrency Market: “Victims” of Economic Fluctuation

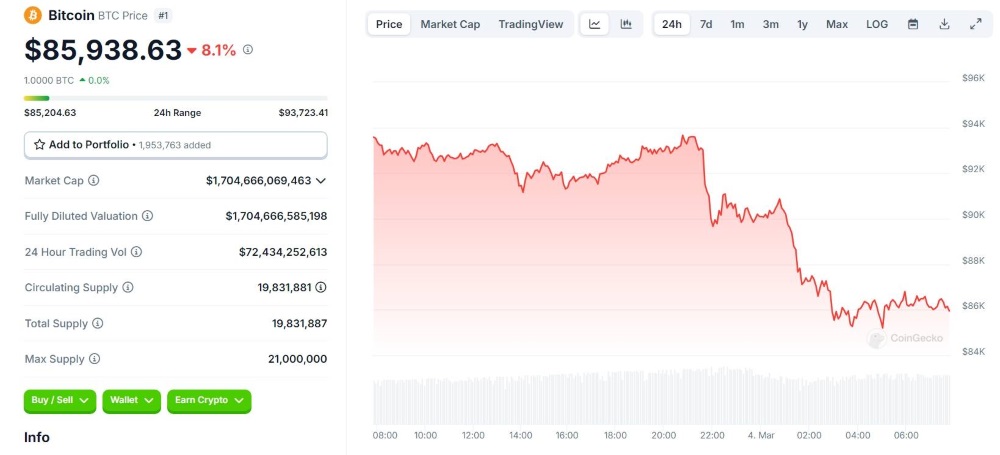

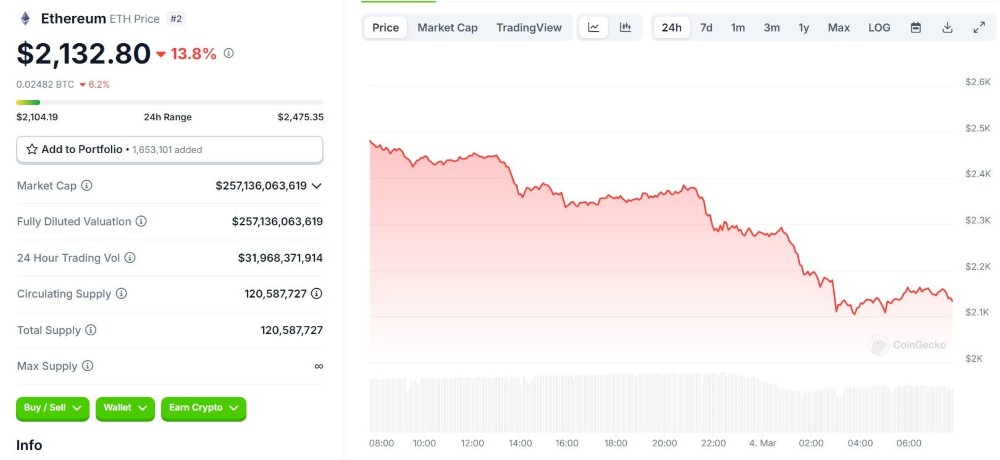

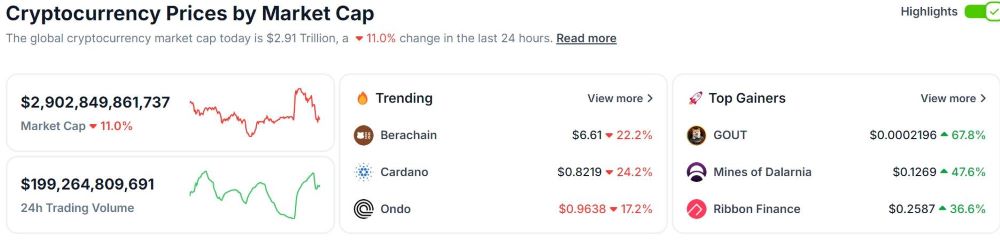

The cryptocurrency market, known for its sensitivity to macro-economic volatility, was not spared from the chaos. Bitcoin plummeted from $95,000 to $86,062 within hours, marking a 10% decline. Ethereum (ETH), the second-largest cryptocurrency, suffered an even steeper drop of 15%, falling from $2,550 to $2,130. Other altcoins, including XRP, SOL, and ADA, faced losses ranging between 15% and 20%.

According to CoinGlass, a staggering $810 million worth of derivatives positions were liquidated in the past 24 hours, predominantly from long positions. This indicates that investors had been overly optimistic about the market’s previous rally, particularly after reports suggested that Trump was planning to establish a national crypto reserve consisting of BTC, ETH, XRP, SOL, and ADA. However, the abrupt implementation of tariffs shattered this confidence.

The total cryptocurrency market capitalization plummeted 11%, dropping to $2.9 trillion—its lowest level since November 2021. Meanwhile, Bitcoin dominance surged back to 58%, suggesting that investors were prioritizing Bitcoin as a safe-haven asset over riskier altcoins. The Fear & Greed Index plunged to 15, signaling extreme fear, a level of uncertainty unseen since Bitcoin fell below $80,000 in late February 2025.

Global Reactions to Trump’s Tariff Policies

Trump’s decision faced strong backlash from affected nations:

- Canada: Prime Minister Justin Trudeau condemned the tariffs, emphasizing that they would severely damage North American trade, particularly in energy and agriculture.

- Mexico: As a key automobile and electronics exporter to the U.S., Mexico raised concerns about losing billions in revenue and thousands of jobs.

- China: Facing the highest tariff hike, China is expected to retaliate with aggressive economic measures. Analysts predict that Beijing could impose counter-tariffs on U.S. goods, reduce its holdings of U.S. Treasury bonds, or accelerate its strategy to move away from reliance on the U.S. dollar. Such actions could escalate the ongoing U.S.-China trade war, which has been a source of tension for years.

Long-Term Impact on the Crypto Market

Beyond its immediate consequences, this tariff hike raises critical questions about the long-term outlook for the cryptocurrency market. Earlier, news of TSMC—the world’s leading semiconductor manufacturer—investing $100 billion into five production facilities in Arizona had boosted investor optimism. This project was expected to create thousands of jobs and strengthen U.S. technological dominance, indirectly benefiting industries linked to blockchain and Bitcoin mining. However, this optimism has now been overshadowed by the new tariff policies.

As the U.S. economy weakens, capital inflows into high-risk assets like cryptocurrencies could continue to decline. The Federal Reserve now faces a major dilemma—should it cut interest rates to stimulate the economy, or maintain current rates to keep inflation under control? This decision will have a direct impact on Bitcoin and the broader crypto market in the coming months.

Trump’s tariff policy has triggered a financial earthquake, sending Bitcoin plummeting to $86,000 and dragging the entire market into deep red territory. Stay tuned to MevXBot for the latest market updates!