Mt. Gox, once the world’s largest Bitcoin exchange before its collapse, has drawn attention once again with a massive transaction, moving over $1 billion in Bitcoin to an anonymous wallet. This marks the first major activity from the exchange since January 2025, sparking speculation that the long-awaited creditor repayments may finally be underway. Amid a volatile crypto market, this event has not only captured the community’s interest but also impacted Bitcoin’s price.

A Massive Transaction Signals Mt. Gox’s Return

According to data from Arkham Intelligence, approximately two hours before this article was written (March 5, 2025), a wallet labeled as Mt. Gox, with the address “1PuQB,” transferred 11,834 BTC—equivalent to $1.07 billion—to the wallet “1Mo1…9gR9.” Shortly after, the exchange moved an additional 166.5 BTC (around $15.12 million) to the address “1Jbez.” In total, these transactions mark the most significant movement from Mt. Gox in nearly two months, following its last recorded activity in late January 2025.

Analysts believe that this substantial Bitcoin movement could be related to the exchange’s asset management strategy, possibly in preparation for repaying long-awaiting creditors. However, there has been no official confirmation from Mt. Gox regarding the exact purpose of these transactions, leaving the crypto community in suspense.

The Rise And Fall Of Mt. Gox

Founded in 2010 in Tokyo, Japan, Mt. Gox quickly became the dominant Bitcoin exchange, handling up to 70% of the global Bitcoin trading volume by 2013. At its peak, it was a central hub for crypto trading, playing a crucial role in Bitcoin’s early adoption. However, this success was short-lived.

In early 2014, Mt. Gox abruptly froze all withdrawal requests, leaving users unable to access their funds. Shortly after, the exchange completely halted trading, took down its website, and filed for bankruptcy protection. It was later revealed that the exchange had been hacked, losing over 800,000 BTC—worth billions of dollars at the time. The collapse devastated thousands of investors and marked one of the darkest moments in cryptocurrency history.

Following its downfall, the process of recovery and creditor repayment began, but it has been anything but smooth. Initially, Mt. Gox planned to distribute funds sooner, but in October 2024, the exchange announced an extension of the repayment deadline by 12 months, pushing it to October 31, 2025. This delay disappointed many creditors, but the recent transactions have reignited hopes of an impending resolution.

Mt. Gox’s Current Bitcoin Holdings

According to Arkham Intelligence, Mt. Gox-linked wallets currently hold 36,080 BTC, valued at approximately $3.27 billion as of March 5, 2025. This substantial amount suggests that the exchange still possesses significant assets, potentially enough to cover upcoming repayments. The recent $1 billion transaction could be an initial step in asset distribution, though no official statement has been made.

Some analysts speculate that the Bitcoin may be transferred to intermediary wallets in preparation for repayment, while others believe Mt. Gox is restructuring its asset management strategy. Regardless of the intent, these transactions are being closely watched by investors and creditors alike.

Impact On Bitcoin’s Price

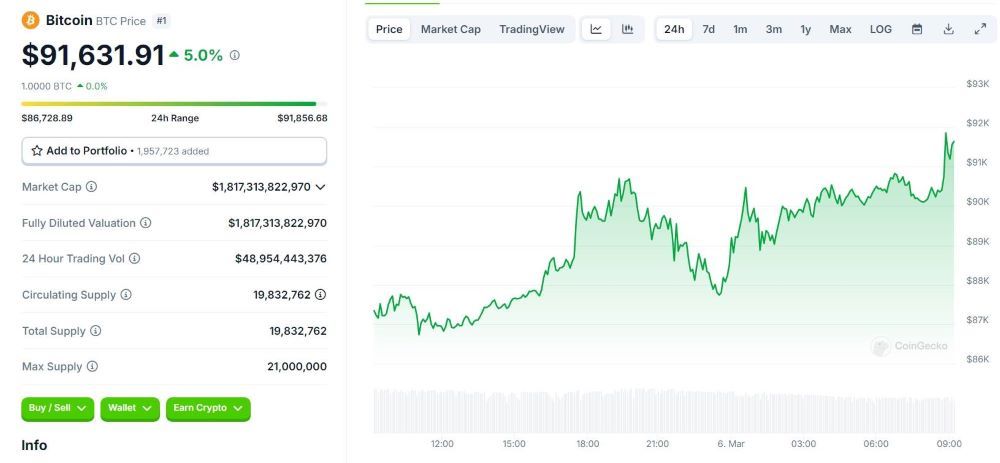

Mt. Gox’s transactions have not only caught the attention of creditors but have also influenced the broader crypto market. In the past 24 hours, Bitcoin’s price has surged, reaching $91,903—a strong rebound after spending two days below the $90,000 mark. The previous dip was largely attributed to concerns over tax policies introduced by the Trump administration, which created uncertainty among investors. However, the Mt. Gox news appears to have sparked renewed confidence, contributing to Bitcoin’s price recovery.

Despite the optimism, not everyone is convinced that this is a positive development. Some market analysts warn that if Mt. Gox releases a large volume of Bitcoin into the market at once, it could trigger a sell-off, leading to a sharp price decline. Similar events have occurred in the past when bankrupt exchanges liquidated their holdings, causing significant market corrections.

Mt. Gox And the Future Of Creditor Repayments

More than a decade after the infamous hack, thousands of Mt. Gox creditors are still waiting for their Bitcoin to be returned. The recent transaction offers a glimmer of hope, but the key question remains: Is Mt. Gox finally initiating repayments, or is this merely an internal asset movement? With the final repayment deadline set for late October 2025, the crypto community is monitoring every development closely.

Additionally, this event raises broader concerns about asset management in the cryptocurrency industry. Major exchanges such as Binance and Bybit have since invested heavily in security and transparency to prevent a repeat of the Mt. Gox disaster. However, the downfall of the once-dominant exchange remains a cautionary tale, emphasizing the risks of centralized platforms and the importance of investor due diligence.

MevXBot will continuously deliver rapid updates, ensuring the crypto community stays informed with accurate and timely information.