Curious about what does bonded mean in meme coins? This guide unveils the mechanics behind bonding, a key feature driving meme coin popularity. From pricing to community growth, discover five essential facts to navigate this crypto trend confidently.

What Is Bonding in Meme Coins?

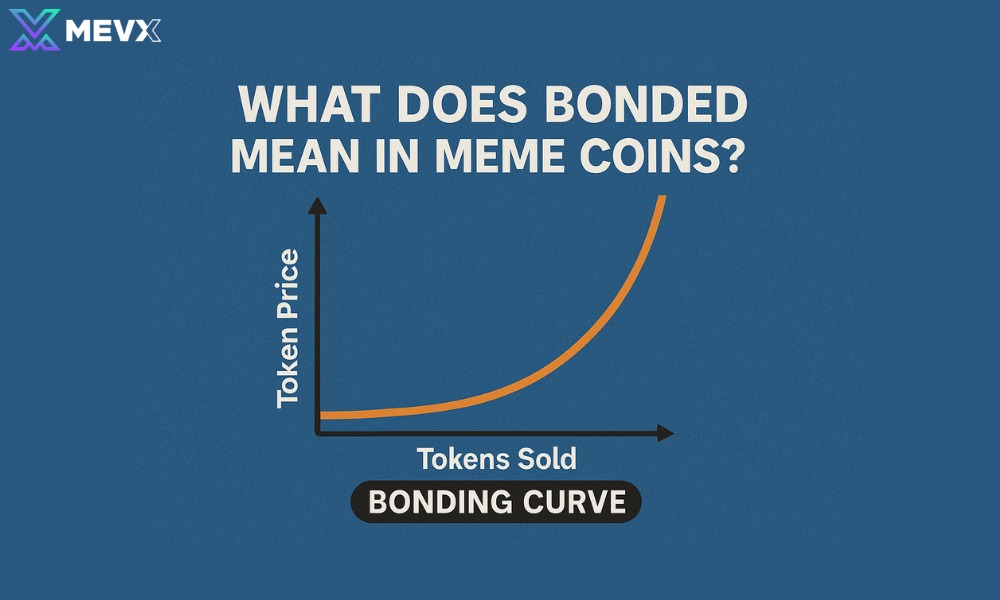

Meme coins thrive on viral trends, but their long-term success often depends on innovative tokenomics. One such mechanism is bonding, where a token’s price is algorithmically tied to its supply using a bonding curve, a mathematical formula that adjusts the price as more tokens are bought or sold. This creates a self-regulating market dynamic, setting meme coins apart from traditional cryptocurrencies.

Unlike standard exchanges where prices fluctuate based on trading activity, bonding curves provide predictable, transparent pricing. This automation not only simplifies access but also lowers entry barriers, drawing in curious investors eager to participate in emerging digital economies.

How Bonding Curves Shape Meme Coins

At the heart of what does bonded mean in meme coins lies the bonding curve. This tool determines how much you pay for a token based on how many are already in circulation. As demand grows, prices rise, rewarding early adopters and fueling hype.

Linear Bonding Curves

Linear curves increase prices gradually, promoting stability. They’re ideal for meme coins aiming for steady growth rather than wild spikes, appealing to cautious investors.

Exponential Bonding Curves

Exponential curves, on the other hand, drive rapid price jumps. These attract thrill-seekers chasing quick gains but can lead to volatility if hype fades, a hallmark of hot network currencies.

Why Bonding Benefits Meme Coins

Bonding isn’t just a gimmick, it offers real advantages. Understanding what does bonded mean in meme coins reveals how it strengthens projects and their communities.

Guaranteed Liquidity

Bonding curves ensure you can always buy or sell tokens, unlike traditional markets where liquidity can dry up. This makes meme coins appealing for traders who value flexibility in the crypto space.

Building Loyal Communities

By rewarding early buyers with lower prices, bonding fosters dedication. A strong community can propel a meme coin’s value, as fans spread the word on social platforms, driving organic growth.

The Risks of Bonding in Meme Coins

While bonding sounds promising, it’s not flawless. Knowing what does bonded mean in meme coins also means recognizing potential downsides that could affect your wallet.

Price Swings

Bonding curves can amplify volatility, especially in exponential models. A sudden surge or drop in demand can send prices soaring or crashing, making meme coins riskier than stablecoins.

Scam Potential

Some projects manipulate bonding curves to favor insiders, leading to pump-and-dump schemes. Always research a coin’s team and mechanics to avoid falling for flashy promises.

Examples of Bonded Meme Coins in Action

To fully grasp what bonded means in meme coins, it helps to explore projects that use bonding mechanisms to stand out in the crowded crypto market. Mint Club, for example, empowers users to create meme coins with custom bonding curves, enabling automatic price adjustments as tokens are bought or sold.

This user-friendly platform has launched countless viral tokens, proving how bonding democratizes crypto creation and lowers entry barriers. Meanwhile, pioneers like Zora and Pump.fun also utilize bonding to control token supply and ensure market dynamics remain sustainable. These platforms show how bonding can turn even the most whimsical internet memes into structured, value-driven ecosystems.

Is Investing in Bonded Meme Coins Worth It?

Deciding whether to jump into meme coin investments requires a clear understanding of what bonded means in this context and a careful evaluation of the associated risks and rewards. Bonded meme coins often use bonding curves, where the token price increases as more tokens are sold, potentially offering high returns for early investors.

However, these coins can be highly volatile, driven by social trends and speculation. When evaluating opportunities, it’s important to diversify your portfolio to cushion against potential losses. For safer investing, always review the project’s bonding curve mechanics, assess the strength of its community, and verify the transparency of the development team. Stick to a well-defined budget and avoid making impulsive decisions based on hype, especially in the ever-shifting world of crypto.

The Future of Bonding in Crypto

Bonding is reshaping how we think about meme coins and beyond. By exploring what bonded means in meme coins, you’re tapping into a trend with far-reaching potential. Innovations like adaptive bonding curves are emerging to reduce volatility and attract more serious investors, signaling a shift toward greater reliability and sustainability in digital assets.

What started with meme coins is now expanding into broader blockchain applications, NFTs and DeFi projects are adopting bonding mechanisms to enhance liquidity and price discovery. This growing versatility suggests that bonding could become a foundational element in the evolving crypto ecosystem.

Bonding adds structure to the chaotic world of meme coins, offering liquidity and community incentives. By understanding what does bonded mean in meme coins, you’re ready to explore this crypto frontier. Curious for more? Check out MevXBot for guides on airdrops, DeFi, and trending tokens!