The global financial markets are showing signs of recovery following reports that Canada and the U.S. are renegotiating tariff policies. This move has been well-received by investors, as previous tariff measures had significantly impacted both the U.S. stock market and the cryptocurrency sector.

Overview of the U.S. 25% Tariff Implementation

As reported by Coin68, on March 3 (U.S. time), President Donald Trump officially imposed a 25% tariff on imported goods from Canada and Mexico. This action, executed after a month-long delay, has had a considerable negative effect on both financial and cryptocurrency markets.

Following the tariff announcement, U.S. stocks experienced a sharp decline, leading to a drop in crypto prices as well. Bitcoin and major altcoins suffered significant losses, reversing gains made prior to the news. This development came right after the Trump administration announced the establishment of a crypto reserve fund, which includes BTC, ETH, XRP, SOL, and ADA, late on March 3.

Canada’s Response to U.S. Tariff Policies

In recent developments, Canadian Prime Minister Justin Trudeau has announced that Canada will impose retaliatory tariffs against the U.S. Specifically, Canada will implement a 25% tariff on imported U.S. goods, amounting to CAD 30 billion (approximately USD 20 billion). This measure is set to take effect immediately, with the possibility of additional tariffs in the future, potentially reaching CAD 125 billion.

The Canadian government has also stated that it will not lift tariffs unless the U.S. takes similar actions. Trudeau labeled the U.S. tariff policy as “foolish,” arguing that it could weaken the economy of a long-standing ally. Canada has also declared its intent to take the issue to the World Trade Organization (WTO), citing provisions from the United States-Mexico-Canada Agreement (USMCA).

Meanwhile, Mexico has yet to issue an official response on the matter.

Bitcoin Sees Mild Recovery After Sharp Drop

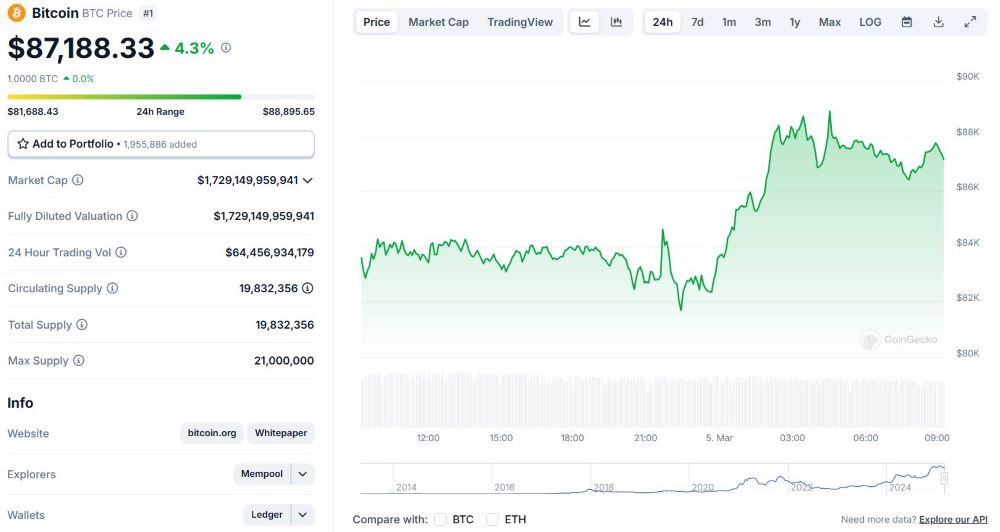

At the time of writing, Bitcoin is trading at USD 87,100, marking a 4% increase from its low of USD 81,500 last night. Earlier, Bitcoin briefly approached the USD 89,000 mark following confirmation from Lutnick.

Not only Bitcoin but also major altcoins have experienced significant recoveries, with many assets rising between 5% and over 20%. This suggests that the market is responding positively to the prospect of U.S.-Canada negotiations.

Investors Should Be Cautious of Negotiation Risks

Despite the ongoing market recovery, investors should remain mindful of potential risks stemming from unexpected developments. History has shown that trade negotiations can be prolonged or even collapse at the last minute. In early February, the market experienced similar recoveries, only to decline sharply due to disagreements during trade discussions.

Additionally, recent tariff measures from the Trump administration have had a significant impact on U.S. stocks and, particularly, the cryptocurrency market. Investor sentiment has become increasingly sensitive to macroeconomic factors, especially those related to economic policies from major global economies.

The Impact of Tariffs on the Crypto Market

The trade tensions between the U.S. and Canada have not only affected traditional financial markets but have also had a direct impact on cryptocurrencies. As concerns over economic downturns rise, investors tend to seek safe-haven assets such as gold and Bitcoin. This explains why BTC and major altcoins rebounded quickly after the sharp drop.

Moreover, if Canada and the U.S. reach a new trade agreement, it could ease pressure on financial markets, creating a more favorable environment for crypto market growth. Should negotiations prove successful, Bitcoin prices may continue to rise in the near future.

As the cryptocurrency market becomes increasingly influenced by macroeconomic factors, keeping a close watch on political and economic developments is crucial. MevXBot will continue to provide the latest updates on Bitcoin, altcoins, and key trends in the crypto market.