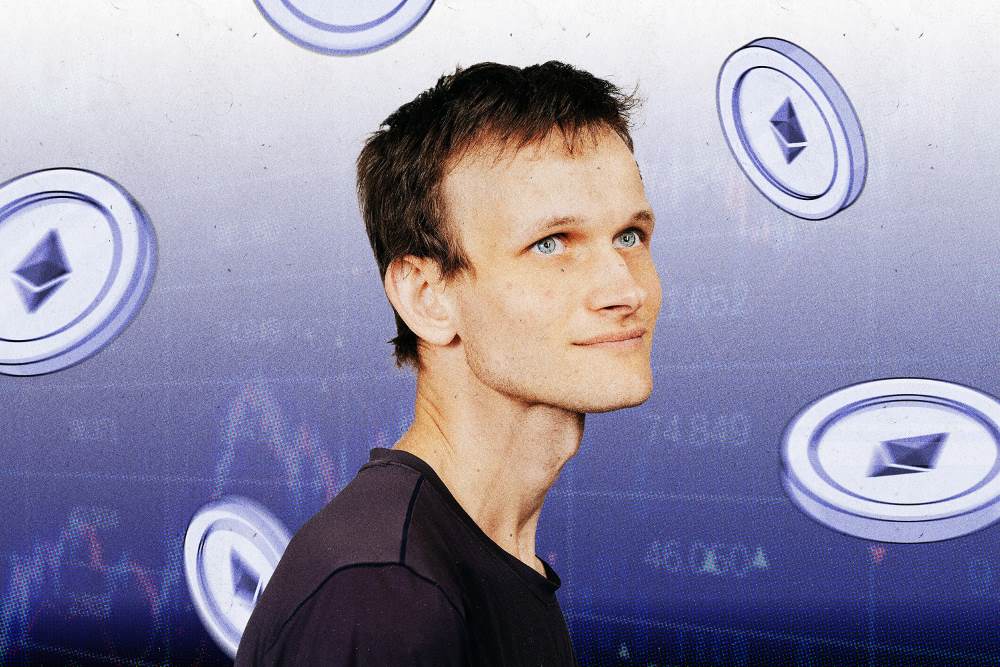

Ethereum is gradually entering the Layer 2 era with the strong development of scaling solutions such as Arbitrum, Optimism, and zkSync. However, Vitalik Buterin, co-founder of Ethereum, still emphasizes the importance of improving scalability on Layer 1. Recently, he proposed increasing Ethereum’s gas limit by 10 times, a move that could significantly change how the network processes transactions and data.

The Layer 2 World Still Depends on Layer 1

On March 05, 2025, Vitalik Buterin, Ethereum’s co-founder, sparked attention with a recent post, arguing that Layer 1 (Ethereum mainnet) requires significant expansion to bolster the thriving Layer 2 ecosystem. As Ethereum pursues its rollup-centric strategy, the gas limit of Layer 1 has emerged as a critical issue, with Buterin asserting that increasing it not only enhances censorship resistance but also ensures a sustainable foundation for the network’s future.

Ethereum Raises Gas Limit: A Step Forward, But Not Enough?

Recently, the Ethereum community reached a consensus to raise the gas limit from 30 million to 36 million Gwei, a notable advancement aimed at boosting the main chain’s transaction processing capacity. However, Vitalik believes this adjustment falls short of addressing real-world demands. He advocates for a bold shift: increasing the gas limit tenfold to approximately 360 million Gwei. According to him, such a move is vital to preserve Layer 1’s pivotal role in an ecosystem increasingly reliant on Layer 2 solutions.

This raises a key question: With Layer 2 platforms like Optimism and Arbitrum handling the bulk of transactions and applications, is expanding Layer 1 truly necessary? Vitalik insists that Layer 1 cannot be overlooked, as it remains the foundational backbone of the entire Ethereum network.

The Core Reason Behind the Proposal

A central pillar of Vitalik’s argument is that raising the gas limit would strengthen Ethereum’s censorship resistance. He emphasizes that a public blockchain must guarantee that any valid transaction, backed by sufficiently high gas fees, is promptly included on-chain. Currently, many Layer 2 solutions employ centralized Sequencers to order and execute transactions, introducing potential censorship risks from these entities. While users can bypass this by submitting transactions directly to Layer 1 (known as bypass transactions), exorbitant gas fees or limited blockspace on Layer 1 render this safeguard ineffective.

Vitalik estimates that to keep bypass transactions viable, Ethereum’s Layer 1 needs to scale by at least 4.5 times its current capacity. Without this expansion, Layer 2’s censorship resistance could weaken, particularly as rising transaction fees hinder users’ ability to exercise their right to submit directly to the main chain.

Asset Transfers Between Layer 2

As Ethereum’s ecosystem grows, the need to move assets between Layer 2 solutions has become indispensable. For widely used assets like ETH or stablecoins, users can leverage intent-based protocols (e.g., ERC-7683) for swift transfers. However, for less-traded assets or NFTs, moving between Layer 2s requires routing through Layer 1.

At present, withdrawing from Layer 2 to Layer 1 consumes around 250,000 gas, while redepositing costs an additional 120,000 gas. With average gas fees, transferring an NFT between two Layer 2s can cost up to $13.87—a significant expense for frequent users. Vitalik highlights that this process demands Layer 1 confirmation, including state root updates and transfer execution, driving up costs. He predicts that expanding Layer 1 by about 5.5 times could slash this fee to just $0.28, delivering substantial savings for users.

Layer 2 Collapse Scenario: Can Layer 1 Handle the Load?

Vitalik also warns of a troubling scenario: What happens if a major Layer 2, such as Arbitrum or Optimism, fails, prompting millions of users to withdraw assets to Layer 1 simultaneously? With its current structure, Ethereum can only process about 7.56 million withdrawals in a week. If a Layer 2 hosts 100 million users, an emergency exodus could overwhelm the network, causing severe congestion.

To avert this, Vitalik argues that Layer 1 must scale at least ninefold to secure enough blockspace for handling massive transaction volumes during crises. This underscores his view that Layer 2 cannot fully supplant Layer 1; rather, both must evolve in tandem.

Challenges of Expanding Layer 1

While expansion offers clear advantages, it comes with risks. A higher gas limit would rapidly inflate the blockchain’s state, making it harder for individuals to run full nodes. This could lead to centralization, as only well-resourced organizations might afford to maintain nodes. Additionally, hardware costs for operating a full node would rise, potentially reducing the number of participants securing the network—a core tenet of Ethereum’s decentralization ethos.

Vitalik acknowledges this as a significant trade-off. He has compiled Ethereum’s gas needs in a data table, comparing current technology, ideal benchmarks, and the threshold required to keep fees affordable. Based on these figures, substantial Layer 1 expansion is essential to maintain Ethereum’s competitiveness and user-friendliness.

To stay informed with the latest updates, follow MevXBot for real-time news and insights on Ethereum and the crypto world!