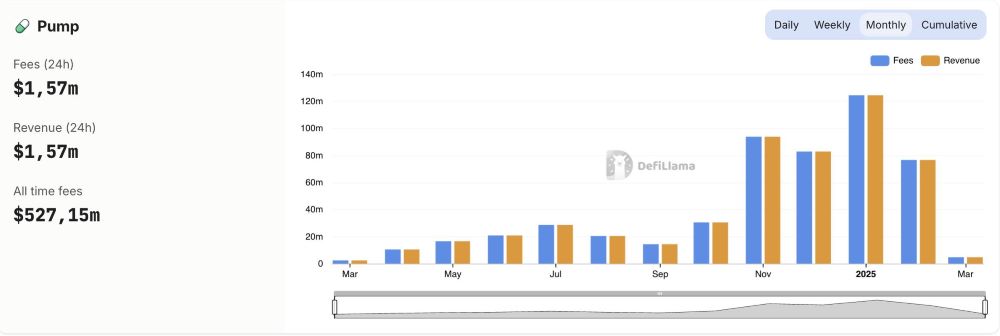

Pump.fun is experiencing a sharp decline in trading volume, dropping 94% from its $3.1 billion peak in January 2025 to $192 million daily. Following the early-year memecoin craze fueled by TRUMP and MELANIA, the Solana-based memecoin market is losing momentum, with fewer new token launches and a declining “graduation” rate on the platform.

Causes and Contributing Factors

Rug Pulls and Fraud Erode Investor Confidence

One of the most disgraceful scandals that shook investor confidence in Solana-based memecoins was the LIBRA incident. This token, widely promoted by Argentina’s President Javier Milei, attracted a massive influx of FOMO-driven investments. However, in a short period, all liquidity was drained, resulting in a total loss of $107 million, with over 86% of investors suffering losses exceeding $1,000.

The Rise of BNB Chain

BNB Chain is emerging as a new hub for memecoins, bolstered by strong ecosystem support and media exposure. Brazilian football legend Ronaldinho has officially launched his own memecoin, STAR10, on BNB Chain, with backing from CZ, the former CEO of Binance.

Additionally, the U.S. Securities and Exchange Commission (SEC) has officially confirmed that memecoins are not classified as securities. This means investors can freely trade them without being subject to the same regulations as traditional securities.

Changes in the Memecoin Ecosystem

Pump.fun Adjusts Its Business Model

Despite the decline in trading volume, Pump.fun continues to evolve by making adjustments to its business model. The platform is hinting at plans to launch its own Automated Market Maker (AMM) to enhance user trading experiences. Additionally, Pump.fun is reportedly negotiating with major centralized exchanges (CEXs) in preparation for the upcoming public sale of its token.

Shift in Capital Flows

The decline of memecoins on Pump.fun partially reflects a shift in capital towards platforms with more developed ecosystems. Platforms with deep liquidity, strong communities, and backing from major funds are gaining a competitive edge as the market becomes increasingly intense. Investors are now prioritizing transparency, security, and long-term growth potential, leading them to explore alternative ecosystems like BNB Chain, which has gained traction with strong network upgrades and endorsements from key industry figures.

Additionally, Ethereum Layer-2 solutions and other emerging blockchain ecosystems are positioning themselves as attractive destinations for memecoin traders. To stay competitive, Pump.fun and similar platforms must innovate by enhancing security measures, fostering a more engaged community, and introducing new incentives. Adapting to evolving trends and strengthening investor confidence will be crucial for sustaining relevance in the rapidly shifting crypto landscape.

Impact on the Crypto Market

With the extreme volatility of memecoins, investors need to adopt well-planned strategies to avoid unnecessary risks. Recent large-scale rug pulls serve as a warning to those looking for quick profits from memecoins. Conducting thorough due diligence on projects, monitoring community activity, and assessing development teams are essential steps to avoid falling into scam traps.

Despite the significant drop in trading volume, memecoins still have the potential for recovery as projects refine their strategies and optimize their offerings. Platforms that maintain transparency, long-term development plans, and credibility will continue to attract investor interest.

Forecast for Memecoins on Solana

Although Pump.fun and Solana-based memecoins face challenges, the platform’s revenue remains stable, exceeding $76.7 million in transaction fees in February 2025. The platform is also advancing its AMM development and negotiating partnerships with major CEXs.

Additionally, Pump.fun is exploring new strategies to expand its user base and attract institutional investors. One potential move is integrating cross-chain functionality, allowing memecoins to be traded seamlessly between Solana and other ecosystems like Ethereum and BNB Chain. This would enhance liquidity and give investors more flexibility when trading tokens.

However, to maintain its position, Pump.fun must adapt to changing memecoin trends, strengthen security measures, and reduce rug pull risks to restore investor confidence. Implementing stricter token listing criteria and introducing advanced auditing mechanisms could help weed out low-quality or fraudulent projects, making the platform a safer environment for traders.

Stay updated with MevXBot for the latest trends in the crypto market and learn how to invest safely in the ever-changing world of memecoins!