The White House has just hosted the first-ever Crypto Summit in history on March 7, 2025, marking a significant turning point in U.S. cryptocurrency policy. This event represents a major shift in the government’s approach to digital assets, as President Trump announced the removal of regulatory barriers, the advancement of a stablecoin regulatory framework, and the establishment of the Strategic Crypto Reserve Fund.

Historic Crypto Summit At The White House

On March 7, 2025 (U.S. time), the White House hosted the first-ever Crypto Summit, marking a significant turning point in the U.S. government’s stance on digital assets. The event took place just hours after President Donald Trump signed an executive order establishing the Strategic Bitcoin Reserve Fund.

The summit was attended by several high-ranking officials from the Trump administration, including:

- David Sacks – Advisor on Crypto and AI Policy

- Scott Bessent – Secretary of the Treasury

- Howard Lutnick – Secretary of Commerce

- Bo Hines – Head of the Presidential Advisory Council on Digital Assets

- Hester Pierce – SEC Commissioner

- Caroline Pham – Acting Chair of the CFTC

Additionally, top executives from major crypto firms such as Coinbase, Kraken, Ripple, Gemini, Chainlink, and Robinhood were present.

President Trump Affirms New Crypto Policies

In his opening speech, President Trump declared that his administration would put an end to the crackdown on the crypto industry, marking the conclusion of what he referred to as the “crypto war” led by the previous government.

He also pledged to fast-track stablecoin regulations before August 2025, ensuring that a clear legal framework is in place before Congress enters recess.

Furthermore, Trump emphasized that the U.S. will retain Bitcoin in its reserves instead of selling it off at undervalued prices, as had been done by previous administrations. The newly established Strategic Crypto Reserve will include BTC, ETH, XRP, SOL, and ADA.

Crypto Policies Implemented By The Trump Administration

In the first two months of his term, President Trump has already introduced several pro-crypto policies, signaling a major shift from the previous administration.

Appointing pro-crypto officials: Key positions in the administration have been filled with figures who have an open stance on digital assets, such as David Sacks, Scott Bessent, and Howard Lutnick. Their backgrounds in finance and technology suggest a more favorable approach toward the crypto industry.

Revamping financial regulatory agencies: Trump has initiated sweeping reforms at the SEC and CFTC, ensuring that these agencies adopt a more balanced regulatory approach toward crypto.

Halting SEC lawsuits against crypto firms: The president has ordered the SEC to drop multiple lawsuits against major crypto companies, including Ripple, Coinbase, and Binance.US.

Supporting the approval of altcoin ETFs: Trump’s administration has instructed the SEC to review and process ETF applications for alternative cryptocurrencies, paving the way for greater institutional adoption.

Establishing a dedicated crypto advisory group: A special advisory committee on crypto policy has been formed to develop a comprehensive regulatory framework that fosters innovation.

Launching the U.S. Strategic Crypto Reserve: One of the most groundbreaking decisions has been the creation of a national crypto reserve consisting of Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA). This move aims to solidify the U.S.’s position in the digital economy while preventing the government from making past mistakes, such as selling off confiscated crypto assets too soon.

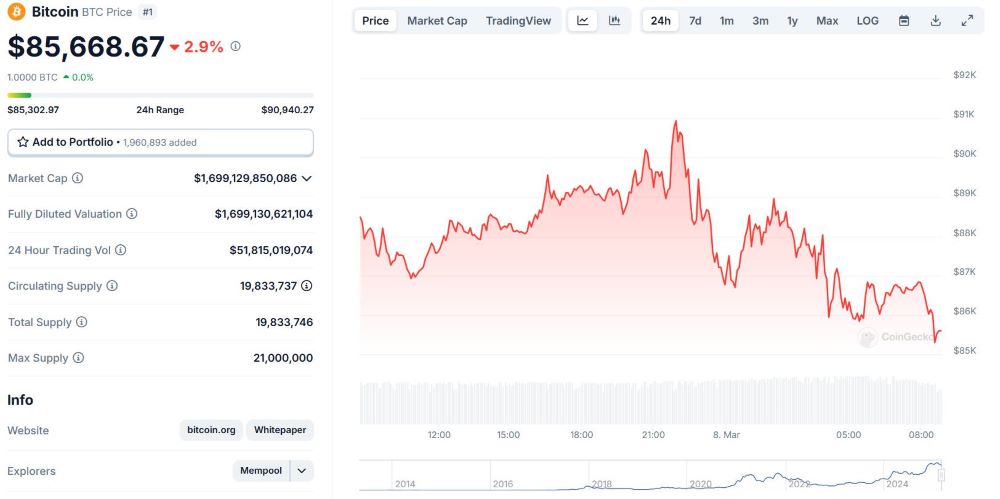

Impact On Bitcoin Price

Despite the positive outlook surrounding Trump’s new crypto-friendly policies, the White House Crypto Summit did not introduce any major surprises, leading to minimal market reaction.

At the time of the event, Bitcoin was trading around $86,500, reflecting a 3% decline over the past 24 hours. Investors remain cautious, closely monitoring further policy developments from the Trump administration to assess their long-term impact on the crypto market.

For detailed updates on this event and in-depth analysis of its impact on the crypto market, follow MevX to stay informed on the latest developments from the White House and the global crypto community.