In the dynamic world of cryptocurrency, where volatility is a constant companion, understanding metrics like the trading range and standard deviation can provide traders and investors with significant insights. For a promising cryptocurrency like Kaspa (KAS), these metrics become essential tools to evaluate price movements and make informed decisions.

In this guide, we’ll dive deep into the trading range and standard deviation of Kaspa, explaining what they are, why they matter, and how to calculate them in detail.

What is Kaspa (KAS)?

Kaspa (KAS) is a high-speed cryptocurrency built on blockDAG technology, which allows for scalable, secure, and near-instant transactions. Its innovative approach makes it a standout in the crypto space, but like most cryptocurrencies, its price can be volatile.

Investors and traders looking to maximize returns must analyze Kaspa’s price behavior, and the trading range and standard deviation are two crucial metrics to achieve this.

Understanding the Trading Range

The trading range represents the spread between the highest and lowest prices of an asset over a specific timeframe. It provides a clear picture of how much the price fluctuated during that period.

Formula: Trading Range = Highest Price − Lowest Price

Significance

- Volatility Measurement: A wider trading range indicates higher volatility, while a narrower range suggests stability.

- Support and Resistance Levels: The trading range often helps traders identify key price levels for making entry and exit decisions.

- Market Sentiment: An expanding range could indicate heightened market activity, while a contracting range might suggest consolidation.

Example: If Kaspa’s price fluctuates between $0.02 and $0.035 over a week: Trading Range = 0.035 − 0.02 = 0.015

This means the price moved within a $0.015 range during the specified timeframe.

What is Standard Deviation?

Standard deviation is a statistical tool used to measure the dispersion or volatility of an asset’s price around its average. It quantifies how much the prices deviate from the mean, providing an indicator of market risk.

Significance

- Risk Evaluation: A higher standard deviation suggests greater price fluctuations, signaling more risk and potentially higher rewards.

- Market Trends: Helps determine whether prices are consolidating or preparing for a breakout.

- Strategy Optimization: Enables traders to adjust their strategies based on the volatility of the market.

Formula and Steps to Calculate Standard Deviation

- Gather Price Data: Collect a series of price points over a specific period. For example, Kaspa’s daily prices over a week might be:

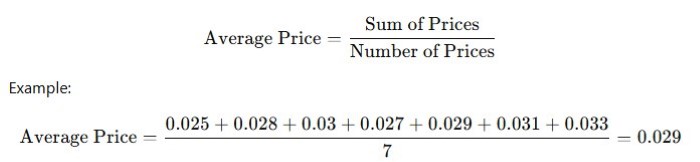

$0.025, $0.028, $0.03, $0.027, $0.029, $0.031, $0.033. - Calculate the Average Price: Add up all the prices and divide by the total number of prices.

Find Deviations: Subtract the average price from each price point.

Example: $0.025 – $0.029 = -0.004, $0.028 – $0.029 = -0.001, $0.03 – $0.029 = 0.001,…

Square the Deviations Square each deviation to eliminate negative values.

Example: $(-0.004)^2 = 0.000016, $(-0.001)^2 = 0.000001, $(0.001)^2 = 0.000001,…

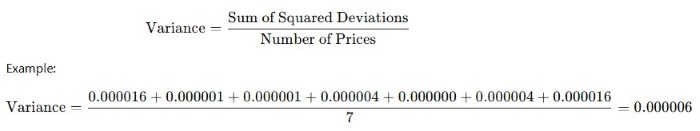

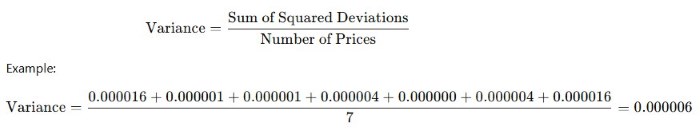

Calculate Variance: Add all the squared deviations and divide by the total number of data points to find the variance.

Find the Standard Deviation: Take the square root of the variance.

What is the Trading Range of Kaspa Standard Deviation?

The trading range of Kaspa’s standard deviation combines the concepts of trading range and volatility, giving a holistic view of its price behavior. It shows how much the price fluctuates within a given timeframe, factoring in the deviations from the mean.

Example Calculation: Using the data above:

- Trading Range: $0.035 – $0.02 = $0.015

- Standard Deviation: Approximately $0.00245

This means that while Kaspa’s price fluctuated within a $0.015 range, its average deviation from the mean price was $0.00245.

How to Use These Metrics for Kaspa Analysis

- Risk Management

Use the standard deviation to set realistic stop-loss and take-profit levels based on volatility.

Avoid trades during periods of excessive volatility if you are a conservative investor.

- Timing the Market

A widening trading range and increasing standard deviation often indicate potential breakouts or trend reversals.

- Identifying Opportunities

Compare Kaspa’s standard deviation to other cryptocurrencies to determine relative volatility.

A lower standard deviation might indicate a more stable investment, while a higher one could signify speculative opportunities.

The trading range and standard deviation are invaluable tools for evaluating the price behavior of Kaspa (KAS). By understanding these metrics, investors can gain insights into its volatility, assess risks, and make more informed trading decisions.

For those navigating the volatile cryptocurrency market, mastering these concepts will provide a significant advantage. Whether you’re a day trader looking for quick profits or a long-term investor seeking stability, these metrics will guide your strategy effectively.