On the morning of March 7, 2025, David Sacks, the Presidential Advisor on Crypto and AI Policy, announced that President Donald Trump had signed an executive order to establish the US Strategic Bitcoin Reserve. This decision marks a significant milestone in the Trump administration’s cryptocurrency policy.

Purpose and Management of the Reserve

According to Sacks, the reserve will receive all Bitcoin currently held by the US government, which has been confiscated from criminal activities and legal proceedings in the past. At present, the US government holds approximately 200,000 BTC, equivalent to $18 billion, but this amount has never undergone an official audit. President Trump has ordered regulatory agencies to review and verify all these crypto assets.

Value Preservation, No BTC Sales

Advisor Sacks emphasized that the US government will not sell the Bitcoin in the reserve. Instead, it will use it as a store of value to maximize its worth. He compared the reserve to a “Fort Knox” for digital gold. According to Sacks, if the US had not auctioned off its BTC holdings in previous years, Washington could have gained an additional $17 billion.

He further elaborated that Bitcoin’s scarcity and decentralized nature make it a highly valuable asset in the long run, particularly as global financial systems evolve. By holding onto its Bitcoin reserves, the US government is positioning itself to benefit from potential future price appreciation. Additionally, this move could serve as a hedge against inflation and economic uncertainty, reinforcing Bitcoin’s role as a strategic financial asset.

Sacks also indicated that maintaining a significant Bitcoin reserve would enhance the US’s influence in global crypto markets. If the US were to retain its BTC holdings over time, it could exert greater control over market dynamics and reinforce its leadership position in digital asset regulation. This decision signals a shift toward treating Bitcoin as a sovereign asset class rather than merely a speculative instrument.

Expanding Asset Portfolio

Beyond Bitcoin, the U.S. strategic reserve will incorporate confiscated cryptocurrencies like Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA), bypassing market purchases. This diverse asset inclusion highlights the government’s acknowledgment of the cryptocurrency ecosystem’s role in fostering financial stability and innovation. Meanwhile, the Treasury and Department of Commerce are tasked with exploring Bitcoin acquisition strategies—excluding taxpayer funds—potentially tapping into surpluses, regulatory fees, or private partnerships to bolster the nation’s digital asset stance.

Officials are also weighing the long-term impact of embedding these assets into national financial systems, possibly leveraging blockchain for transparency or integrating them into state-backed instruments. As plans solidify, further details on acquisition methods and asset management are anticipated in the coming months, signaling a proactive shift in the U.S.’s approach to cryptocurrencies.

The White House And The Crypto Summit

Just hours after announcing the reserve, the White House also confirmed the first-ever Crypto Summit. The event is set to bring together top executives and leaders from the largest crypto firms in the US. Topics are expected to include new regulatory frameworks for cryptocurrency.

The summit is anticipated to serve as a platform for discussions on how the US can regain its leadership in the global cryptocurrency sector. Industry leaders are expected to push for clearer regulations, an end to regulatory uncertainty, and policies that foster innovation while ensuring consumer protection. President Trump is scheduled to deliver the keynote speech, where he may unveil additional policy initiatives to further integrate cryptocurrencies into the US financial system.

Moreover, the summit will address concerns surrounding security, compliance, and taxation in the crypto space. The involvement of top financial regulators and policymakers indicates a significant shift in Washington’s stance on digital assets. This event could mark the beginning of a more collaborative approach between the US government and the cryptocurrency industry.

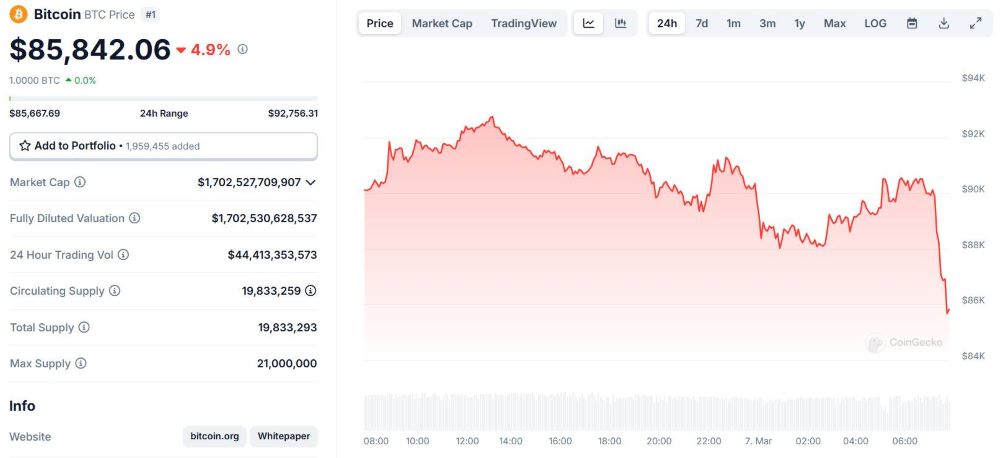

Market Reaction: Bitcoin Price Drop

Despite the positive news about the reserve, Bitcoin’s price dropped from $91,000 to $85,800 due to a “sell the news” reaction. Investors may have anticipated that the US government would actively buy more BTC from the market rather than simply holding confiscated assets.

Additionally, market analysts suggest that some traders were disappointed by the absence of an immediate large-scale government purchase, which could have driven Bitcoin’s price higher. While the long-term implications of the reserve are bullish, short-term price volatility is expected as investors digest the full impact of this policy shift.

For real-time updates on Bitcoin price movements and in-depth market analysis, follow MevXBot for the latest crypto news.