President Donald Trump’s announcement of the Crypto Strategic Reserve – a national digital asset reserve for the United States – has sent shockwaves through the crypto market. Altcoins surged, while Bitcoin Dominance took a sharp hit, marking a pivotal shift in the global crypto landscape.

Bitcoin Loses Market Dominance Following Trump’s Announcement

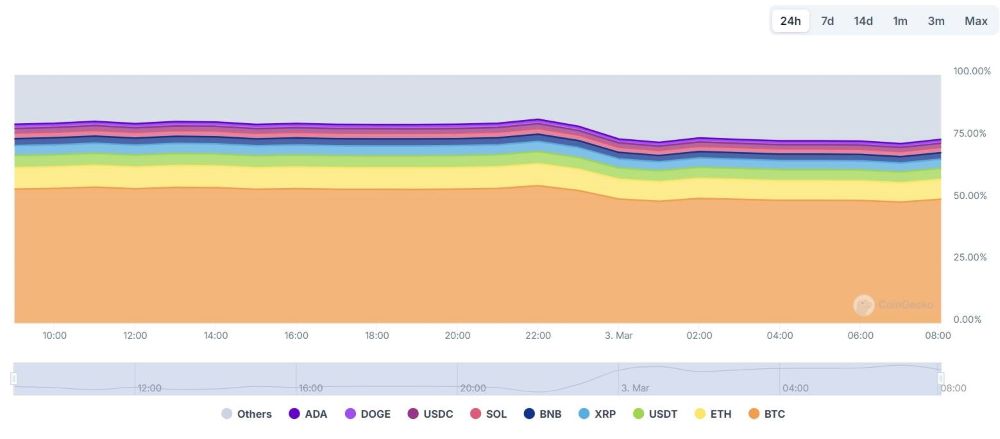

The crypto market recently experienced significant volatility, with Bitcoin Dominance – the ratio of Bitcoin’s market cap to the total crypto market – plummeting from 55.4% to below 50%.

Previously, Bitcoin was widely regarded as the most important asset in the crypto space. However, Trump shocked the industry by stating that the reserve would not only include Bitcoin but also altcoins, specifically XRP (XRP), Solana (SOL), and Cardano (ADA).

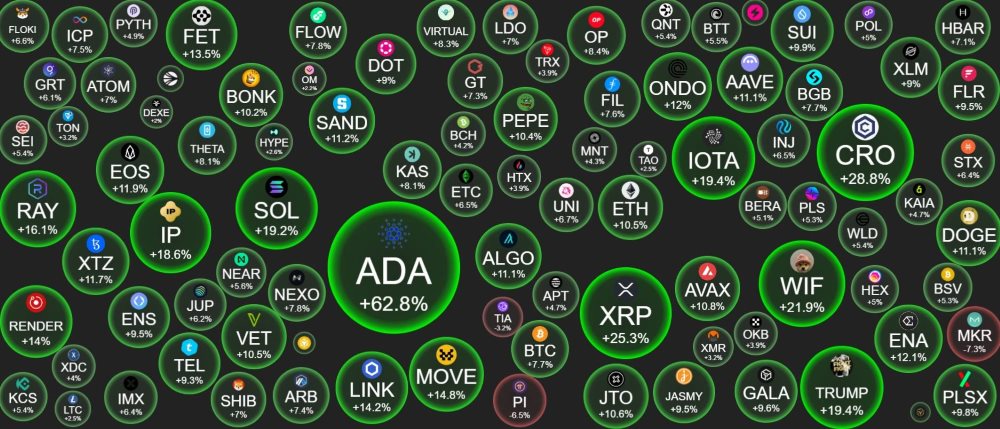

Following this announcement, altcoins saw a sharp price surge in the past 10 hours:

- Cardano (ADA) up 61.2%

- XRP up 24.2%

- Solana (SOL) up 18.6%

Ethereum (ETH) also surged nearly 10%, reflecting the growing optimism in the crypto market. Meanwhile, Bitcoin experienced an impressive recovery, jumping by $10K from approximately $85,000 to $95,000 in less than a day.

This rapid price movement comes in response to recent policy announcements from the U.S. government regarding crypto regulation and the establishment of a national crypto reserve. Analysts believe that the renewed bullish momentum in Bitcoin and Ethereum signals strong investor confidence, especially as institutional demand continues to rise.

The rapid rise of altcoins has significantly weakened Bitcoin’s market share, leading to disappointment among BTC supporters. Many had hoped that Trump would prioritize Bitcoin as the sole strategic reserve asset, rather than diversifying into other cryptocurrencies.

Crypto Strategic Reserve – Bold Move or Risky Gamble?

The creation of the Crypto Strategic Reserve was not a spontaneous decision. According to White House sources, this plan had been under thorough review for weeks by the Digital Assets Task Force, led by Bo Hines – head of the Crypto Council – and David Sacks, Trump’s Crypto & AI Policy Advisor.

Furthermore, Trump is set to host a Crypto Summit at the White House on March 7. This will be a historic event, marking the first time the White House has officially discussed crypto policy with major industry leaders, including:

- David Sacks, Trump’s Crypto & AI Policy Advisor (Summit Host)

- Bo Hines, Representative of the Crypto Council (Summit Coordinator)

- Top executives from major U.S. crypto firms

The discussions will focus on crypto regulation, stablecoin oversight, and the future of digital assets in the U.S. economy.

Potential Risks of the Crypto Strategic Reserve

Including altcoins in the reserve may help Trump gain broader support from the crypto community, particularly from altcoin investors. However, this decision also comes with significant risks, such as:

- High volatility of altcoins: Unlike Bitcoin – which is widely recognized as a store of value – many altcoins have greater price fluctuations and higher risks of devaluation.

- Division within the crypto community: Bitcoin maximalists may oppose Trump’s decision, creating a divide between BTC supporters and altcoin investors.

- Political risk: If the Crypto Strategic Reserve fails or sparks controversy, it could become a weak point in Trump’s administration.

What’s Next for the Crypto Market?

With the White House Crypto Summit approaching on March 7, the global crypto community eagerly awaits further details on Trump’s policies. Will this initiative truly position the U.S. as the world’s crypto capital, or is it simply a high-stakes gamble? Stay tuned to MevXBot for the latest updates from the White House and the global crypto market!