The HB230 bill was still passed in Utah, but the most important provision regarding Bitcoin investment and reserves was completely removed. This is a significant development as more U.S. states consider adding Bitcoin to their official reserve assets.

Utah Passes HB230 Bill

On March 7, the Utah Senate officially passed the HB230 bill (Blockchain and Digital Innovation Amendments) with a vote of 19-7-3. However, the most crucial provision that would allow the state government to invest in and reserve Bitcoin was removed just before the final voting round. Initially, HB230 allowed the Utah state treasurer to invest up to 5% of the state’s total digital assets in cryptocurrencies with a market capitalization of over $500 billion in the previous year. Currently, Bitcoin is the only currency meeting this condition. If this provision had remained, it could have been a major turning point for Utah’s financial system.

On March 7, the Utah Senate officially passed the HB230 bill (Blockchain and Digital Innovation Amendments) with a vote of 19-7-3. However, the most crucial provision that would allow the state government to invest in and reserve Bitcoin was removed just before the final voting round. Initially, HB230 allowed the Utah state treasurer to invest up to 5% of the state’s total digital assets in cryptocurrencies with a market capitalization of over $500 billion in the previous year. Currently, Bitcoin is the only currency meeting this condition. If this provision had remained, it could have been a major turning point for Utah’s financial system.

Utah Removes Bitcoin Reserve Fund Provision

This provision initially passed the second voting round but was unexpectedly scrapped in the final vote by the Utah Senate. The Utah House later agreed to this change through a 52-19-4 vote, leaving only provisions protecting custody rights, mining, node operation, and Bitcoin staking for Utah residents. The HB230 bill has now been sent to Governor Spencer Cox for approval, the final step before it becomes law. If signed, Utah will still protect Bitcoin-related activities but will have no plans to invest in or reserve the asset.

Why Utah Removed the Bitcoin Reserve Fund

Senator Kirk A. Cullimore, one of the bill’s sponsors, stated that concerns over risks and policy feasibility were the main reasons for removing the Bitcoin reserve fund provision. State officials fear that Bitcoin remains a highly volatile asset, and there is no broad consensus on including it in official reserves. Additionally, regulatory and financial safety concerns played a crucial role in the decision. Some lawmakers worry that investing in Bitcoin could expose the state’s budget to risks, especially in the event of a severe cryptocurrency market downturn.

U.S. Federal Government’s Bitcoin Strategy

Utah’s move comes as President Donald Trump signed an executive order establishing a federal-level Bitcoin reserve fund. Initially, this fund will receive all Bitcoin controlled by the U.S. government, primarily from BTC assets seized in criminal cases and law enforcement operations, rather than purchasing directly from the market as many investors had hoped. However, the U.S. Treasury and Commerce Departments have been directed to develop a neutral budget strategy to acquire more Bitcoin, indicating that the federal government is not stopping at confiscated BTC but has long-term plans to expand its reserves. The establishment of a federal Bitcoin reserve fund could significantly influence Bitcoin investment trends in states. If successful, other states may follow this model to develop long-term financial strategies based on Bitcoin.

Utah Withdraws From The Bitcoin Reserve Race

Utah was once considered a leading candidate to become the first U.S. state to establish a Bitcoin reserve fund. However, with this last-minute change, the state has officially withdrawn, leaving Texas and Arizona at the forefront of adopting Bitcoin as an official reserve asset. In Texas, SB-21 has already passed the Senate and is awaiting House approval before being presented to the Governor for enactment. If approved, Texas could become the first state to officially reserve Bitcoin, marking a significant milestone in cryptocurrency recognition within the traditional financial system. Meanwhile, Arizona is also advancing with two proposals, SB1373 and SB1025, both of which have cleared the Senate and are currently under review by the House Rules Committee before a vote. Beyond Texas and Arizona, 25 out of 31 Bitcoin reserve bills remain active across various U.S. states, including Oklahoma, Florida, Georgia, Iowa, Kentucky, Maryland, Michigan, and Ohio. If more states proceed with these plans, Bitcoin could gradually become an integral part of the U.S. financial economy.

States Opposing Bitcoin Reserve Funds

However, not all states support Bitcoin reserves. Some, such as Pennsylvania, Montana, South Dakota, Wyoming, and North Dakota, have officially rejected these proposals, similar to Utah. The primary reasons remain concerns over price volatility, unclear legal frameworks, and the challenges of managing digital assets. This indicates that while Bitcoin is gaining broader recognition, significant hurdles remain before it can become an official part of state budgets across the U.S.

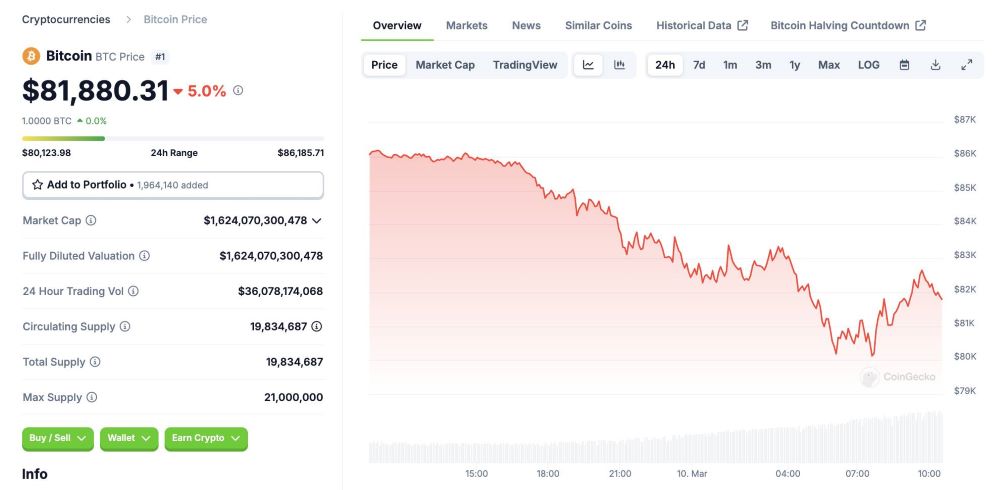

Current Bitcoin Price Trends

At the time of writing, Bitcoin is trading around $81,880, down over 5% in the past 24 hours. This volatility reflects investor concerns over policy changes regarding Bitcoin at both state and federal levels.  Despite this, analysts remain optimistic about Bitcoin’s long-term prospects, especially as more institutions and governments consider incorporating BTC into official asset portfolios. This could create more investment opportunities and further solidify Bitcoin’s position as a key store of value in the future. For the latest insights and updates on crypto policy and market trends, follow MevXBot for comprehensive, real-time updates to help investors navigate this dynamic landscape.

Despite this, analysts remain optimistic about Bitcoin’s long-term prospects, especially as more institutions and governments consider incorporating BTC into official asset portfolios. This could create more investment opportunities and further solidify Bitcoin’s position as a key store of value in the future. For the latest insights and updates on crypto policy and market trends, follow MevXBot for comprehensive, real-time updates to help investors navigate this dynamic landscape.