In the fast-paced world of cryptocurrency, price differences between exchanges create constant opportunities. Manually tracking them is nearly impossible, but arbitrage trading bots are designed to automate this process with precision and speed. These powerful tools can scan markets and execute trades 24/7, turning market volatility into a strategic advantage. This guide explains how they work and what you need to know to get started.

What is crypto arbitrage and how do bots help

In cryptocurrency, arbitrage is buying an asset on one exchange and selling it for a higher price on another. This strategy exploits temporary price discrepancies for the same asset across different markets. Executing it profitably requires immense speed and precision, which is something humans cannot achieve consistently.

This is where arbitrage trading bots come in. A bot automates the entire process, constantly monitoring prices across multiple exchanges. It identifies profitable opportunities and executes orders in milliseconds. By doing so, it capitalizes on market inefficiencies that are too fleeting for manual traders to catch.

How arbitrage trading bots provide an edge

The core advantage is processing vast data without emotional bias. These bots execute trades on pure logic, removing human error. This systematic approach is crucial in a market defined by rapid price swings. They leverage technology to exploit opportunities beyond human reach, turning complex cryptocurrency market volatility analysis into profit.

Key strategies used by arbitrage trading bots

Arbitrage trading bots are not one-size-fits-all. They employ various crypto arbitrage strategies to find and exploit price differences. The complexity can range from simple two-way trades to intricate multi-step transactions, with each method suited for different market conditions.

Simple arbitrage

Also known as cross-exchange arbitrage, this is the most straightforward strategy. The bot seeks a price difference for a single crypto pair between two exchanges. For instance, if Bitcoin is cheaper on Binance than on Coinbase Pro, the bot buys on Binance and sells on Coinbase Pro, capturing the spread minus fees.

Triangular arbitrage

This more advanced strategy occurs on a single exchange. It involves trading between three different cryptocurrencies to end with more of the initial asset. A bot might trade USD for BTC, then BTC for ETH, and finally ETH back to USD. If exchange rates are imbalanced, the final amount is higher than the start.

Decentralized arbitrage

This strategy operates on decentralized exchanges (DEXs) and is often related to Maximal Extractable Value (MEV). Bots look for opportunities within a single blockchain block, exploiting price differences on platforms like Uniswap. This field is highly competitive, requiring sophisticated undefined to succeed.

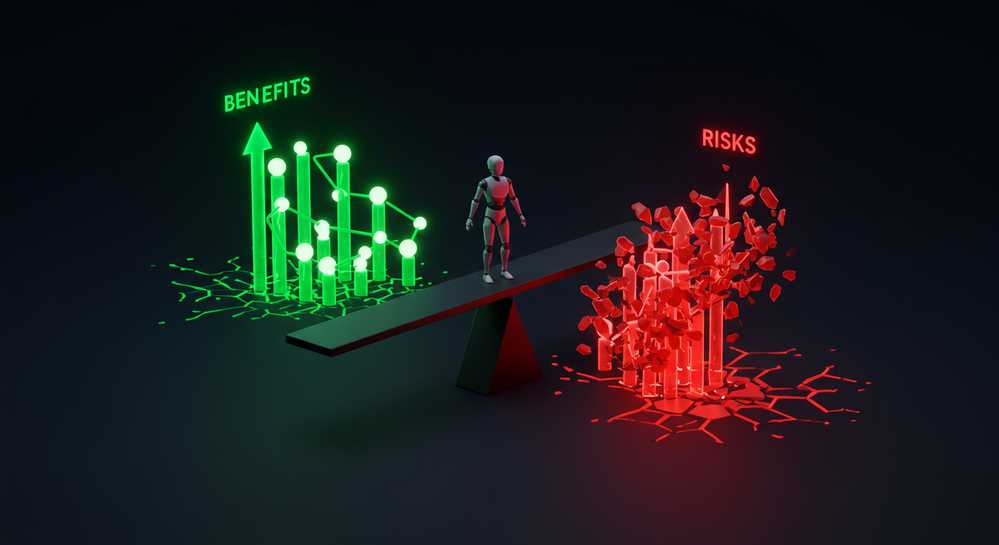

The real benefits and risks of arbitrage automation

Automating arbitrage offers significant advantages, but it is not without its challenges. Understanding both sides is crucial before deploying capital. The risks can quickly outweigh the rewards if not managed properly, making a balanced view essential for success with arbitrage trading bots.

Primary benefits of automation

- Speed and Efficiency: Bots analyze market data and execute trades far faster than any human, which is vital for capturing fleeting opportunities.

- 24/7 Market Monitoring: The crypto market never sleeps. A bot operates around the clock, ensuring no potential profit is missed.

- Emotionless Trading: Bots stick to a predefined strategy, removing emotional decisions like fear or greed that often lead to errors.

Common risks to consider

- Execution Risk: This includes slippage, where the final price differs from the expected price, and failed transactions during high volatility.

- Transaction Fees: Costs like gas fees or exchange commissions can erode profits. Understanding the specific undefined structure is a key part of risk management.

- API and Exchange Reliability: Bots depend on exchange APIs. Downtime, slow responses, or withdrawal freezes can disrupt operations and trap funds.

How to choose the right arbitrage trading bot

Selecting the right tool is just as important as understanding the strategy. A poorly designed bot can lead to losses, security vulnerabilities, and missed opportunities. When evaluating different arbitrage trading bots, focus on these critical factors to ensure you choose a reliable and effective platform for your needs.

- Security: Ensure the platform uses secure practices for handling API keys and user data. Never grant withdrawal permissions to your API keys to protect your funds.

- Performance and Speed: The bot must be fast enough to execute trades before the price gap closes. Check reviews or performance data on its execution speed.

- Supported Exchanges and Pairs: The more exchanges and trading pairs a bot supports, the more opportunities it can find. Verify that it works with the exchanges you use.

- User Interface and Ease of Use: A clean, intuitive interface is vital, especially for beginners. Finding the undefined often comes down to usability.

- Pricing and Fee Structure: Understand how the service charges. Factor its subscription or profit-sharing fees into your potential profitability.

- Support and Community: Reliable customer support and an active community can be invaluable for troubleshooting and learning best practices.

Ultimately, arbitrage trading bots offer a powerful way to leverage market inefficiencies for profit. They transform a complex, high-speed strategy into an automated process. Success depends on understanding the underlying risks and choosing a secure, high-performance tool. Platforms like MevXBot are designed to provide that crucial edge, empowering traders to navigate the crypto markets with precision and confidence.